Think of procurement benchmarking like checking your toolbox before starting a build. If you don’t know what tools you have, how sharp the saw is, or where the nails are, the job gets messy fast.

Procurement benchmarking is simply checking how you buy things, covering the price, the speed, and the quality, and comparing it to what other people do or to your own best work. That comparison shows you where you’re doing well and where you’re losing money or time.

Now, in 2026, prices jump, workers are harder to find, and rules about the environment and safety keep changing. So guessing doesn’t cut it anymore.

Benchmarking helps you pinpoint where you are losing money by identifying the true impact of what are procurement costs on your projects.

Benefits of Procurement Benchmarking

When you benchmark procurement, you get a clear picture of how your buying works and where to fix things. Here are the main wins:

● Save Money

First, you save money. Companies that check how they buy can often cut costs by about 8–15%. Firms using AI and real-time data can sometimes reach up to 20% savings. In construction, even a 4–6% saved on materials adds up because materials are a big part of the total cost.

● Speed & Transparency

Second, you move faster with procurement benchmarks. Supplier choices and approvals often speed up by about 30% when processes are set up right. That means fewer delays, fewer frantic calls, and fewer rush orders that cost extra.

● Keep Project On Time

Third, you reduce site delays. If materials show up when they should, say, 95% of the time, labor can keep building. A single late delivery can stop a project for a day or more and cost thousands.

● Avoid Maverick Spend

Fourth, you cut maverick spend. That’s the money people spend outside approved suppliers or rules. Benchmarking helps reduce this by 5–10%, which prevents waste and makes budgeting steadier.

● Stakeholder alignment & ESG

Procurement benchmarks also make everyone stay on the same page. The finance team, project team, and sustainability team all look at the same numbers and understand them the same way. Investors also trust companies more when they can clearly show they care about the environment and follow the rules in a real, measurable way.

Challenges Of Procurement Benchmarking

Benchmarking is great, but it can be hard to start. Here’s why:

● Data Fragmentation

Project sites, ERP, spreadsheets, and supplier portals don’t talk. This affects ~70% of procurement teams in some way. In other words, many companies have data spread all over: some in big systems, some in Excel files, and some in people’s heads. That makes it tricky to compare things.

● Resource Limits

Starting procurement benchmarking also costs money and time. Mid-sized firms often lack the data team or budget to normalize data. Initial setup can add 10–15% to a project budget.

● Internal Buy-In

People don’t always like change either. If your team is used to doing things a certain way, they may resist new tools or rules.

● Bad Comparisons

Don’t benchmark a mid-market GC against a global giant because apples vs. oranges lead to misleading results. You can experience 20%+ error rates when peer data is poor. In other words, if you compare your small company to a huge global contractor, the results won’t make sense. Comparing similar companies is important.

● Market Volatility

Tariffs, regional supply shocks, and labor gaps make some published benchmarks stale in weeks. Simply put, the market can change fast. Tariffs and price increases mean a benchmark that was good last month might be out of date now. So you’ll need to update and check benchmarks often.

Fragmented data makes it hard to track your performance, but a clear procurement process flow can help centralize your benchmarking data.

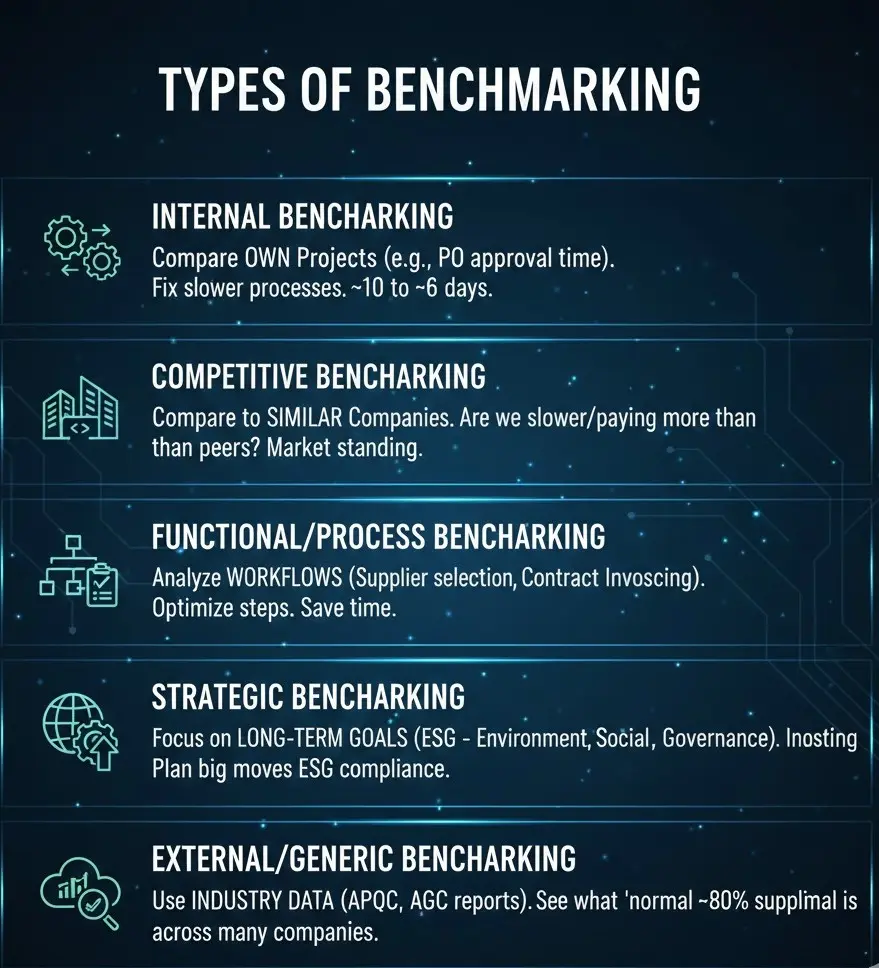

Types Of Benchmarking

There are several ways to benchmark, and each helps in a different way. Let’s explore them below:

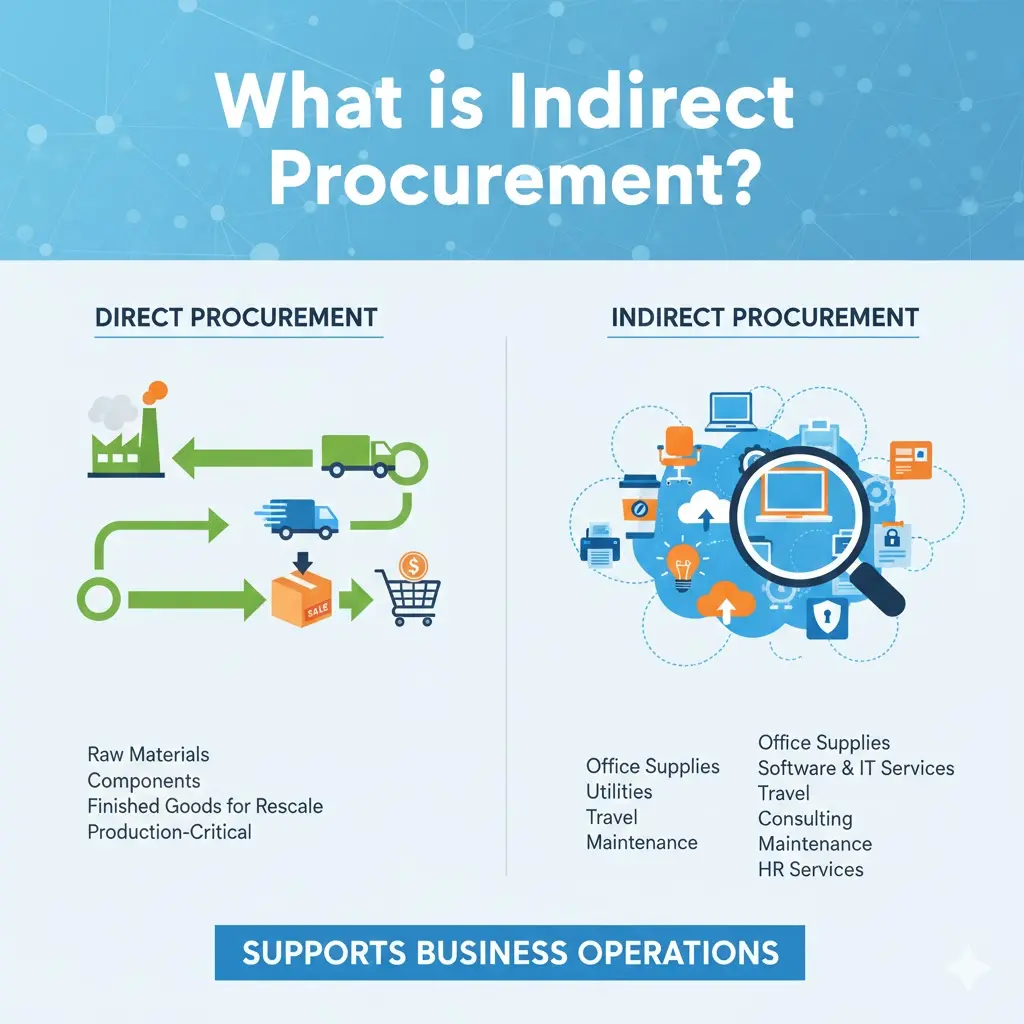

● Internal Benchmarking

Internal benchmarking means comparing your own projects. For example, if Project A takes 6 days to approve a PO and Project B takes 10 days, you can learn from Project A and fix Project B. This type of benchmarking can cut project-specific PO cycle times from ~10 days to ~6 days.

● Competitive Benchmarking

Competitive benchmarking is comparing your company to similar construction firms. This tells you whether you’re paying more or doing things slower than your peers.

● Functional/Process Benchmarking

Functional or process benchmarking looks at workflows:

- How do you choose suppliers?

- How are contracts approved?

- How are invoices handled?

Fixing a slow step can save lots of time.

● Strategic Benchmarking

Strategic benchmarking focuses on long-term goals like ESG (environment, social, governance). This helps you plan big moves, like switching to low-carbon materials. According to a report, this type of benchmarking (ESG) sees top firms reaching ~80% supplier ESG compliance.

● External/Generic Benchmarking

External or generic benchmarking uses industry data from groups, like APQC or AGC. Those numbers tell you what normal looks like across many companies.

Your North Star: Key KPIs to Watch

When dealing with procurement benchmarks, KPIs are the instruments on your dashboard. They tell you if things are smooth or if something’s burning. In other words, if benchmarking is the tune-up, KPIs are the dials you must watch. You pick the right ones, measure them well, and ultimately get early warnings, avoiding surprises later.

Below are the core KPI categories and construction-specific measures you should track.

● Efficiency KPIs: Speed & Cost

Think of this like asking for something and then actually buying it. When someone on a construction project asks for cement, that request is called a requisition. When the company finally decides to buy the cement and places the order, that paper is called a purchase order (PO).

Requisition to PO Time

This just means how long it takes to go from asking to buying. Most construction companies take about 7 to 10 days. Really good companies do it in about 4 days. And the smartest, fully automated systems can do small buys in a few hours, even under 5 hours.

Procurement Cycle Time

This is the whole journey, from the first request all the way until a contract is signed and ready. If this takes too long, the project slows down, and slow projects cost more money.

Cost Per Purchase Order (Cost Per PO)

This is how much money it costs just to process one order, including paperwork, computers, emails, and people’s time. In the past, companies spent more than $100 just to place one order. Today, better systems and automation have lowered this to about $50 to $75 for the best companies.

● Savings KPIs: Financial Wins

Think of this as how smart buying saves actual money.

Hard Savings

This is the easy one to see in procurement benchmarks. It’s when the buying team talks to suppliers and gets lower prices, discounts, or money back later. Professionals call it rebates. If something used to cost $100 and now costs $90, that $10 saved is a hard saving.

Cost Avoidance

This is money you didn’t have to spend, even though prices were going up. For example, if prices were about to increase, but the team locked in the old price early, they avoided paying more. You don’t see this on a receipt, but it still protects the budget.

Procurement ROI (Return on Investment)

This means how much money comes back for every dollar spent on the buying team. A good goal is $5 to $10 saved for every $1 spent. With smart tools and AI helping, this number can go even higher. In simple words, if procurement does its job well, it doesn’t cost money, but it makes money.

● Quality KPIs: Reliability

When you buy construction materials, it’s not just about cost; it’s about getting the right stuff, on time, always.

Supplier Defect Rate

This means how often suppliers send the wrong or damaged materials. If a supplier makes a lot of mistakes, it slows the project and costs extra to fix.

● Contract Compliance

This is about following the rules you agreed on when placing orders. Every purchase order should stick to the agreed price, delivery date, and terms. If it doesn’t, you might get overcharged or delayed.

On-Time Delivery

This is super important in construction procurement benchmarks. If materials don’t arrive when they’re supposed to, labor can’t work, and each day of delay can cost thousands of dollars. Top companies aim for 95–98% of critical materials delivered on time. That keeps projects moving smoothly.

● Construction-Specific KPIs to Track

These are special numbers that construction teams watch closely to run projects well.

Spend Under Management

This tells you how much of the company’s total buying follows the rules. The goal is over 80%, and the best companies hit 85–90%. The higher this number, the more money is controlled and saved.

Maverick Spends

This is when someone buys outside the approved suppliers or rules. Try to keep it under 5–10%. If it’s higher, money can easily get wasted, and projects can get messy.

Total Cost of Ownership (TCO)

Buying something isn’t just about the sticker price. You must think about freight, storage, fixing mistakes, and changes, too. Materials usually make up 30–40% of a project’s cost, so knowing the full TCO helps you save a lot.

Supplier Lead Time Reduction

This measures how many days it takes from ordering to receiving materials. Smart companies use data and planning to cut this time by 20–30%, which keeps construction moving faster.

Purchase Price Variance (PPV)

This tracks how much the price changes from what you expected. Try to keep it under 5%, so surprises don’t blow the budget.

Spend Per Procurement Worker (FTE)

A skilled buying team member can handle $3–5 million per person efficiently. This number can change depending on project size or location, but higher efficiency means fewer people doing more work without mistakes.

Smart tools and AI are driving procurement ROI higher; learn how AI in procurement can automate these KPIs for your team.

2026 Global Procurement Industry Benchmarks

Across industries, procurement leaders are posting 8–12% annual savings by modernizing procurement. In highly automated, AI-enabled organizations, overall savings potentials of ~20% show up in case studies and consulting benchmarks.

For construction in 2026, there are a few important points:

● Material Cost Inflation

Forecasts expect ~2–4% inflation in 2026 in many regions, though pockets (urban centers, certain materials) can be higher. Turner & Townsend and other market trackers show global construction cost inflation around ~4% for 2026.

● Tariffs & Trade

Import tariffs and trade policy create pockets of 25–30% price shocks for some goods in some markets. This volatility means benchmarks can go stale fast. Therefore, you must treat tariff exposure as a separate risk item in benchmarking.

● PO Cycle Times

Industry averages still sit in the 14–21-day range for many firms doing manual workflows; AI and automation reduce that by around 30% in early adopters.

● Modular/Offsite Construction

Modular is now mainstream; market-size estimates around $100B+ (2026) and growing at ~6–8% CAGR; modular sourcing reduces on-site costs by 20–30% in many case studies. Market research sources report modular market sizes in the $100–120B range for 2025–2026.

Proven Strategies to Handle Inflation

Top firms use global supply chains plus predictive analytics to deal with inflation. They lock long-term contracts where strategic, use hedging or regional sourcing when tariffs bite, and push suppliers for data transparency. The result is better protection against 2–4% inflation and the ability to capture margin when peers react late.

With inflation hitting 4%, top firms manage costs by integrating green procurement strategies that offer long-term resource efficiency.

Procurement Best Practices Benchmarks

Here’s a step-by-step process you can follow. Treat it like a project, accounting for objectives, scope, deliverables, owners, and timelines.

1. Plan Objectives & Scope

Decide what problem you want to fix. Is it saving money, avoiding delays, or being more eco-friendly? Start small, like checking only structural materials on three pilot projects.

Pro Tip: Stay focused, as it keeps things manageable and alleviates confusion.

2. Select KPIs

When working on procurement benchmarks, pick 8–12 key numbers (KPIs) that match your goal. For example, if you want faster deliveries, choose lead time and on-time delivery. If saving money is the goal, pick cost per PO or total cost of ownership.

3. Collect & Normalize Internal Data

Pull all your numbers from ERP systems, project management tools, supplier portals, and site logs. Make sure everything uses the same units, such as tons, cubic meters, dollars, or project phases.

Why Normalization Matters? Data might be messy, but normalizing it reduces mistakes by about 20%.

4. Gather External Data

Find trustworthy numbers from industry reports, associations, like AGC or ISM, and verified market research. Don’t rely on anonymous tips from other companies because real, verified data is key for accurate benchmarks.

5. Analyze Gaps & Root Causes

Look for big differences in costs, lead times, or processes. Ask questions/reasons for each gap. Use the 80/20 rule: fix the 20% of problems causing 80% of delays or extra costs first.

6. Develop Action Plans

Decide who will do what and by when. Link improvements to money saved; for example, faster PO approvals to fewer change orders, leading to dollars saved. Assign owners, set milestones, and track progress using KPIs.

7. Implement & Monitor

Start fixing issues and track progress regularly. Use dashboards to get real-time numbers. Automate repetitive tasks first, like supplier onboarding or creating purchase orders, so your team can focus on bigger problems.

8. Review Annually

The world changes fast, including prices and tariffs, as well as labor shortages. Check your benchmarks at least once a year, update them, and reset your targets to stay on top.

If you are benchmarking specialized sectors, compare your gaps against experts in hospitality procurement services companies for niche data.

Why This Workflow Matters?

Doing this can add about 10–15% efficiency improvements. Even small changes, like normalizing data properly, can cut comparison errors by around 20%.

In construction, different projects use different materials mixes. You should always normalize by project type, size, & region. Otherwise, you’ll benchmark a high-rise against a bridge and get unfavorable results.

How to Deal With Maverick Spend?

Before you deal with maverick spend, get its root cause, which may be:

- Catalogs are outdated, so people don’t know what’s allowed.

- Approvals take too long, so workers order themselves.

- The right suppliers are hard to reach on-site.

How to Fix It?

If people buy outside approved suppliers because approvals take too long, fix the approval process by working on the following tips:

- Fast-track the top 30 items for easy mobile ordering.

- Approve small buys under $5k quickly on phones.

- Penalize people who keep breaking rules.

Technology’s Role In Procurement Benchmarking

AI and automation are not what replcing the human. They are the tools that help us work smarter. Here are some of the common tools used by procurement experts:

● Predictive Analytics

These are smart tools that guess future prices and how much stuff you’ll need. That means you can order earlier and pay less, instead of rushing and overpaying.

● Automated Spend Analysis

Using this during procurement benchmarks, you can automatically group all your purchases and find where you can save money, like spotting duplicate buys or finding better deals.

● Smart Contract Tools

As the name shows, smart contract tools make editing and approving contracts much faster, so suppliers start work sooner.

● Real-Time Dashboards

You can understand their role by considering them as live scoreboards that show important numbers. If something looks wrong, you see it right away.

What Can You Expect By Using These Tools?

In 2026, many teams use AI and automation tools for routine tasks, freeing people to solve the harder problems. As per their data, you can experience:

- About 20% savings in some categories.

- Cycle times can fall by around 50% with automation.

- Forecasts get roughly 30% more accurate.

Supplier Relationship Management (SRM) In Procurement Benchmarks

You should deal with suppliers like teammates on your construction project. The better you work together, the smoother the project goes. SRM is just managing your suppliers well, so everyone knows their role, and nothing is forgotten.

Tier Your Suppliers as Per Their Roles!

- Tier 1 (Top Partners): These are super important suppliers. They provide lots of materials and keep the project running. You must work closely with them and plan together.

- Tier 2 (Important but Replaceable): These suppliers matter, but if needed, you can switch. Keep an eye on their deliveries and performance.

- Tier 3 (Everyday Stuff): They are cheap and easy-to-get items. You must focus on price and convenience without doing deep planning with them.

Why Reliable SRM Matters?

Good SRM makes materials arrive on time about 15% more often, reduces mistakes by 20%, and lets you plan with suppliers. This leads to fewer surprises happening on the job site.

How to Conduct a Benchmark Audit

Rely on a consultant to conduct a benchmark audit in the best way. They speed things up, and with their assistance, you can get the following results:

- A short scoping workshop up front.

- Several weeks of data cleaning.

- Mapping your KPIs to industry benchmarks.

- A prioritized roadmap with savings and owners.

Part 6- 2026 Trends: Resilience and ESG Benchmarks

Buying materials for construction isn’t just about spending less money. In 2026, teams also need to focus on resilience. It’s about being ready when things go wrong. And ESG is about being kind to the environment and society. These things are now a big part of how companies make buying decisions.

● Resilience

In procurement benchmarks, resilience is all about being prepared. If a supplier suddenly can’t deliver, the best companies can find another within 48 hours. They also make sure over 70% of critical items can come from different suppliers, so they aren’t stuck if one supplier fails.

To avoid delays, companies sometimes keep small stockpiles of long-lead items. This costs a bit more to store, but can save huge headaches later.

● ESG & Ethical Sourcing

ESG and ethical sourcing are the new rules of the game. Companies must track Scope 3 emissions, which are the carbon from all their suppliers, and show which suppliers follow ESG rules.

Why ESG & Ethical Sourcing Matter?

ESG and ethical sourcing matter because they:

- Reduce Scope 3 emissions by 20–30% over the near term.

- Aim for 80–90% of suppliers to comply with ESG rules.

- Use low-carbon materials like greener concrete.

About 40–50% of advanced firms are already doing this for some items.

● Modular & Off-Site Construction

Construction-specific trends in 2026 show that how and where you get materials matters. Nearshoring, or buying from suppliers closer to your project, can cut tariffs and shipping delays, saving around 10–15%.

Modular and off-site construction (building parts in a factory and assembling onsite) reduces labor needs and can save 20–30% on costs. However, the industry is also facing labor shortages, with many subcontractors hard to find. This can slow projects and increase costs if not managed carefully.

In short, success in 2026 isn’t just about saving money. Construction teams need to plan for unforeseen expenses, buy ethically, use greener materials, and think smart about where and how they get their supplies.

As ESG becomes a core rule for 2026, you can refine your strategy by exploring our guide on sustainable procurement.

A Real-World Case Study

A construction company had a big problem: it took 9 days to turn a material request into an official purchase order (PO). Workers were calling suppliers manually, which slowed everything down, and some were buying outside the approved list, called maverick spend, which was 16% of all purchases.

To solve this, the team took several steps, benefiting from procurement benchmarks:

- Focused on the top 200 most important items first.

- Set up a mobile PO approval system so managers could approve orders quickly on their phones.

- Automated supplier onboarding for these key items, making suppliers ready faster.

- Ran negotiation workshops with the top 10 suppliers to get better prices.

The results were clear and fast:

- Requisition-to-PO time dropped from 9 days to 4 days.

- Maverick spend went down from 16% to 6%.

- Overall material costs fell by around 4% in one year, thanks to faster orders, fewer rush orders, and better negotiations.

- Admin work per PO dropped by 30%, giving the team more time to focus on building.

Follow This Roadmap To Start!

You don’t need a big, full-blown transformation to make a difference. Sometimes, small, smart changes can have a big impact right away. Here are a few things to try now:

- SKU Triage: Pick the top 200 items that cost the most or are the hardest to get. Lock in prices or use two suppliers so you don’t run out.

- Mobile Approvals: Let field teams approve small orders under $5,000 on their phones. This cuts maverick spend quickly.

- Supplier Onboarding Automation: Move supplier sign-up to an online portal. This reduces delays by about 30% and cuts errors.

- Monthly Procurement Stand-ups: A 30-minute meeting with procurement, project leads, and finance. Solve at least 2 supply issues per month.

- Quick Dashboard: Set up one dashboard showing 6 important numbers: PO cycle, maverick spend %, spend under management, supplier on-time delivery, purchase price variance, and procurement ROI. Refresh it weekly to spot problems fast.

Don’t let maverick spend drain your budget. Let Pro Procurement build your roadmap to 4% annual material cost savings.

Frequently Asked Questions

1. How often should you benchmark?

Baseline once, then monitor core KPIs monthly; re-run full external benchmark annually or whenever major shocks occur.

2. Should you buy a fancy tool for procurement benchmarking?

Not always. Fix process issues first. Buy tech for scale after you’ve proven a pilot and defined data flows.

3. What’s a realistic first-year ROI?

For focused pilots, 10–15% improvement in efficiency is common, with procurement ROI of ~5x on transformation spend in many cases.

4. Are modular and off-site methods a procurement advantage?

Yes, modular reduces on-site variability and labor risk and concentrates procurement in factory settings where quality can be controlled.

5. What is the best timeline for action?

You can make a plan of action, using the following options:

- Short-term (90 days)

- Medium (1 year)

- Long-term (3 years).

6. What is Scope 3 emission in procurement benchmarking?

Scope 3 emissions are indirect greenhouse gases from a company’s supply chain, like materials, shipping, and supplier activities. Tracking them helps procurement make eco-friendly, sustainable buying decisions.

Conclusion

Procurement benchmarking isn’t a report to file away. It’s a way to stop guessing and start solving. It lowers costs, speeds projects, and reduces stress. You must start small, measure what matters, and make real decisions from the data.

If you do this right, procurement stops being a cost center and becomes a muscle that protects margins and keeps sites running. If you need assistance in procurement benchmarking, Pro Procurmnet is you go -to. Reach out to the team and learn about the services the company offers!